St Charles Newsfeed Saturday December 6, 2025

Page 5

Housing Market Positioned to Bring Back the Economy

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday May 21, 2020

All eyes are on the American economy. As it goes, so does the world economy. With states beginning to reopen, the question becomes: which sectors of the economy will drive its recovery? There seems to be a growing consensus that the housing market is positioned to be that driving force, the tailwind that is necessary. Some may question that assertion as they look back on the last recession in 2008 when housing was the anchor to the economy – holding it back from sailing forward. But even then, the overall economy did not begin to recover until the real estate market started to regain its strength. This time, the housing market was in great shape when the virus hit. As Mark Fleming, Chief Economist of First American, recently explained: (Article Continues)

Read Full Article ...Housing Market Positioned to Bring Back the Economy

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday May 21, 2020

All eyes are on the American economy. As it goes, so does the world economy. With states beginning to reopen, the question becomes: which sectors of the economy will drive its recovery? There seems to be a growing consensus that the housing market is positioned to be that driving force, the tailwind that is necessary. Some may question that assertion as they look back on the last recession in 2008 when housing was the anchor to the economy – holding it back from sailing forward. But even then, the overall economy did not begin to recover until the real estate market started to regain its strength. This time, the housing market was in great shape when the virus hit. As Mark Fleming, Chief Economist of First American, recently explained: (Article Continues)

Read Full Article ...Why the Housing Market Is a Powerful Economic Driver

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday April 30, 2020

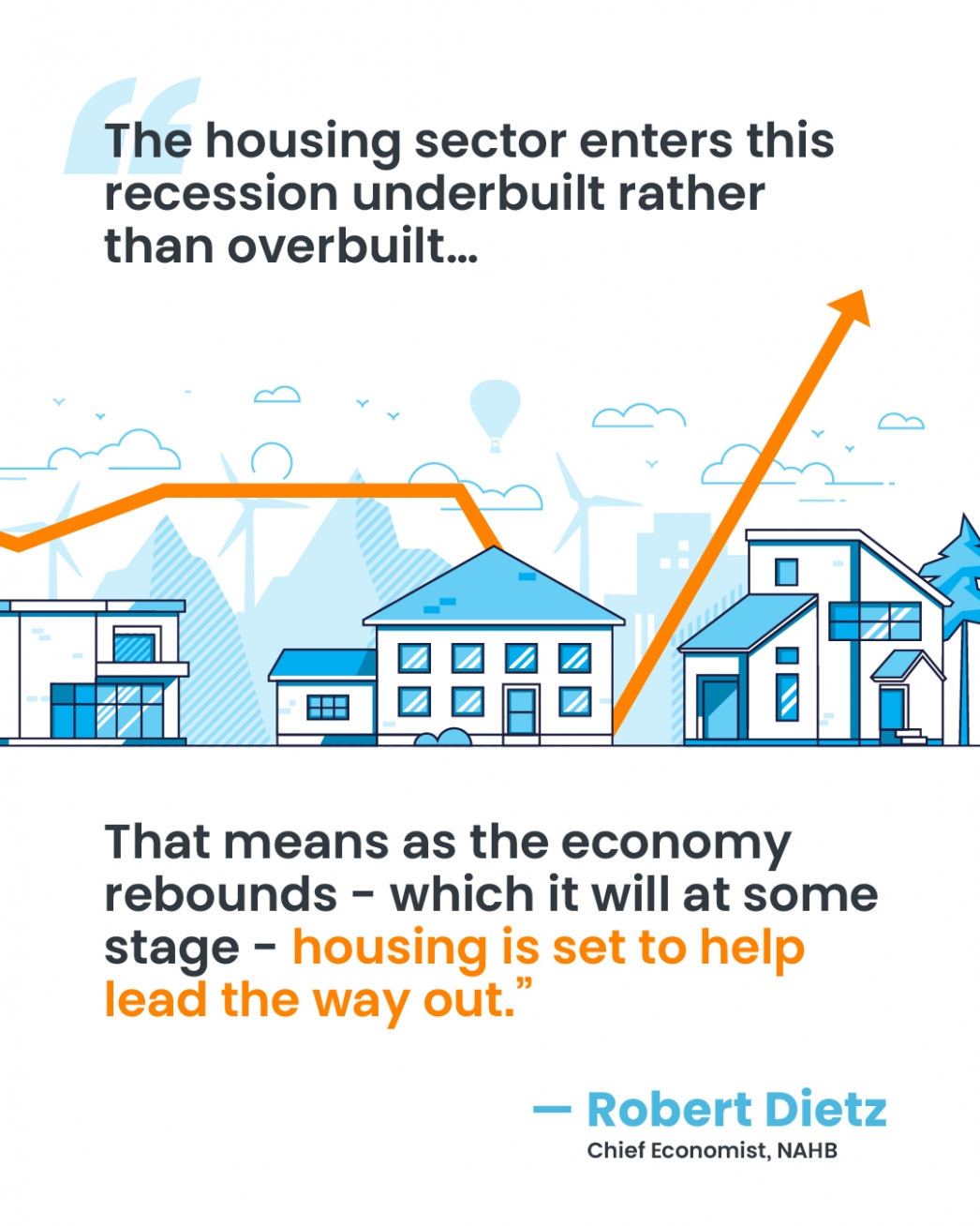

With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned before, buying a home is a driving financial force in this process. Today, many analysts believe one of the first things we’ll be able to safely bring back is the home building sector, creating more jobs and impacting local neighborhoods in a big way. According to Robert Dietz in The Eye on Housing:

Read Full Article ...Why the Housing Market Is a Powerful Economic Driver

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday April 30, 2020

With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned before, buying a home is a driving financial force in this process. Today, many analysts believe one of the first things we’ll be able to safely bring back is the home building sector, creating more jobs and impacting local neighborhoods in a big way. According to Robert Dietz in The Eye on Housing:

Read Full Article ...The Pain of Unemployment: It Will Be Deep, But Not for Long

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday April 21, 2020

There are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million people in the U.S. became instantly unemployed when it was determined that the only way to defeat this horrific virus was to shut down businesses across the nation. One second a person was gainfully employed, a switch was turned, and then the room went dark on their livelihood.

The financial pain so many families are facing right now is deep.

How deep will the pain cut?

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

The Pain of Unemployment: It Will Be Deep, But Not for Long

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday April 21, 2020

There are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million people in the U.S. became instantly unemployed when it was determined that the only way to defeat this horrific virus was to shut down businesses across the nation. One second a person was gainfully employed, a switch was turned, and then the room went dark on their livelihood.

The financial pain so many families are facing right now is deep.

How deep will the pain cut?

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday April 17, 2020

The uncertainty the world faces today due to the COVID-19 pandemic is causing so many things to change. The way we interact, the way we do business, even the way we buy and sell real estate is changing. This is a moment in time that’s even sparking some buyers to search for a better deal on a home. Sellers, however, aren’t offering a discount these days; they’re holding steady on price.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday April 17, 2020

The uncertainty the world faces today due to the COVID-19 pandemic is causing so many things to change. The way we interact, the way we do business, even the way we buy and sell real estate is changing. This is a moment in time that’s even sparking some buyers to search for a better deal on a home. Sellers, however, aren’t offering a discount these days; they’re holding steady on price.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

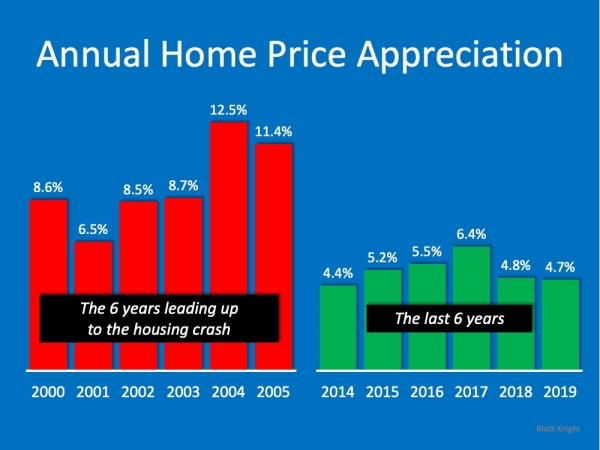

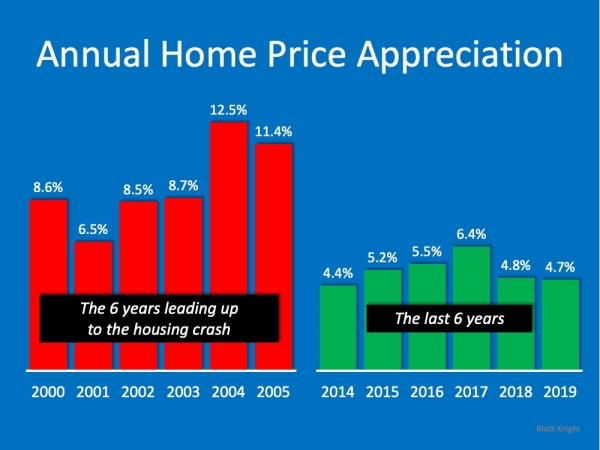

Think This Is a Housing Crisis? Think Again

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday April 15, 2020

With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it’s logical to ask that question.

Many of us experienced financial hardships, lost homes, and were out of work during the Great Recession – the recession that started with a housing and mortgage crisis. Today, we face a very different challenge: an external health crisis that has caused a pause in much of the economy and a major shutdown of many parts of the country.

Let’s look at five things we know about today’s housing market that were different in 2008:

Think This Is a Housing Crisis? Think Again

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday April 15, 2020

With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it’s logical to ask that question.

Many of us experienced financial hardships, lost homes, and were out of work during the Great Recession – the recession that started with a housing and mortgage crisis. Today, we face a very different challenge: an external health crisis that has caused a pause in much of the economy and a major shutdown of many parts of the country.

Let’s look at five things we know about today’s housing market that were different in 2008:

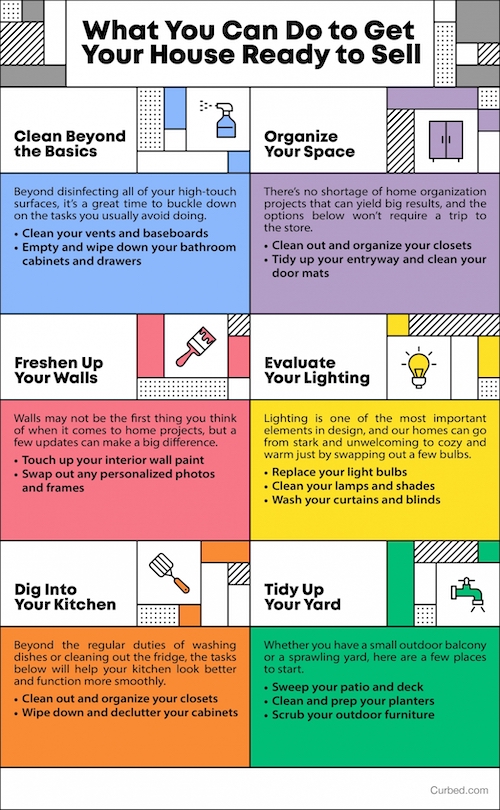

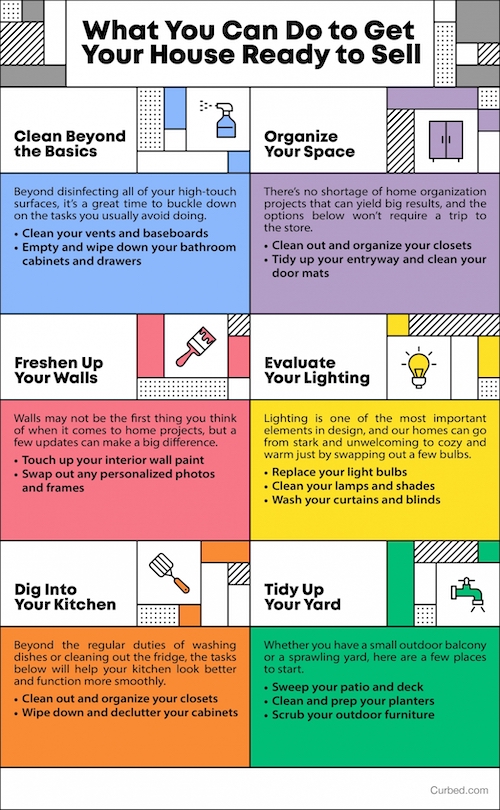

What You Can Do to Get Your St Charles House Ready to Sell [INFOGRAPHIC]

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday April 13, 2020

Some Highlights:

What You Can Do to Get Your St Charles House Ready to Sell [INFOGRAPHIC]

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday April 13, 2020

Some Highlights:

How Technology Is Enabling the Real Estate Process in St Charles

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday April 8, 2020

Today’s everyday reality is different than it looked just a few weeks ago. We’re learning how to do a lot of things in new ways, from how we work remotely to how we engage with our friends and neighbors. Almost everything right now is shifting to a virtual format. One of the big changes we’re adapting to is the revisions to the common real estate transaction, which all vary by state and locality. Technology, however, is making it possible for many of us to continue on the quest for homeownership, an essential need for all.

Here’s a look at some of the elements of the process that are changing (at least in the near-term), due to stay-at-home orders and social distancing, and what you may need to know about each one if you’re thinking of buying or selling a home sooner rather than later:

5 Was to Help:

How Technology Is Enabling the Real Estate Process in St Charles

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday April 8, 2020

Today’s everyday reality is different than it looked just a few weeks ago. We’re learning how to do a lot of things in new ways, from how we work remotely to how we engage with our friends and neighbors. Almost everything right now is shifting to a virtual format. One of the big changes we’re adapting to is the revisions to the common real estate transaction, which all vary by state and locality. Technology, however, is making it possible for many of us to continue on the quest for homeownership, an essential need for all.

Here’s a look at some of the elements of the process that are changing (at least in the near-term), due to stay-at-home orders and social distancing, and what you may need to know about each one if you’re thinking of buying or selling a home sooner rather than later:

5 Was to Help:

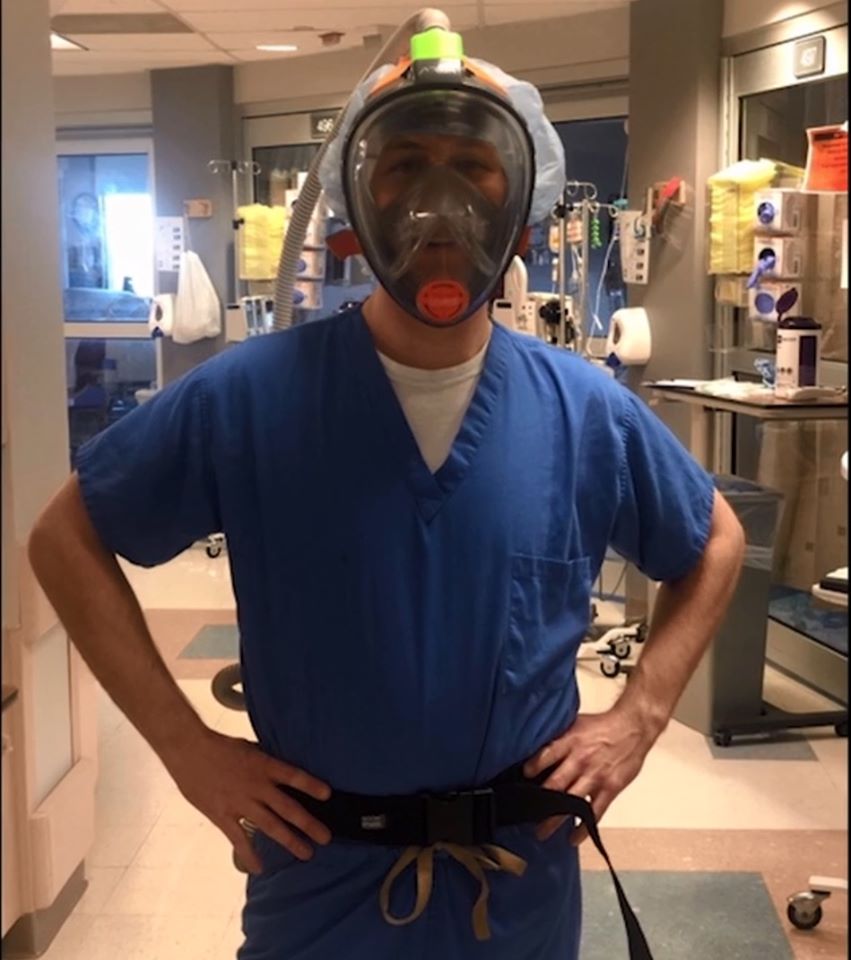

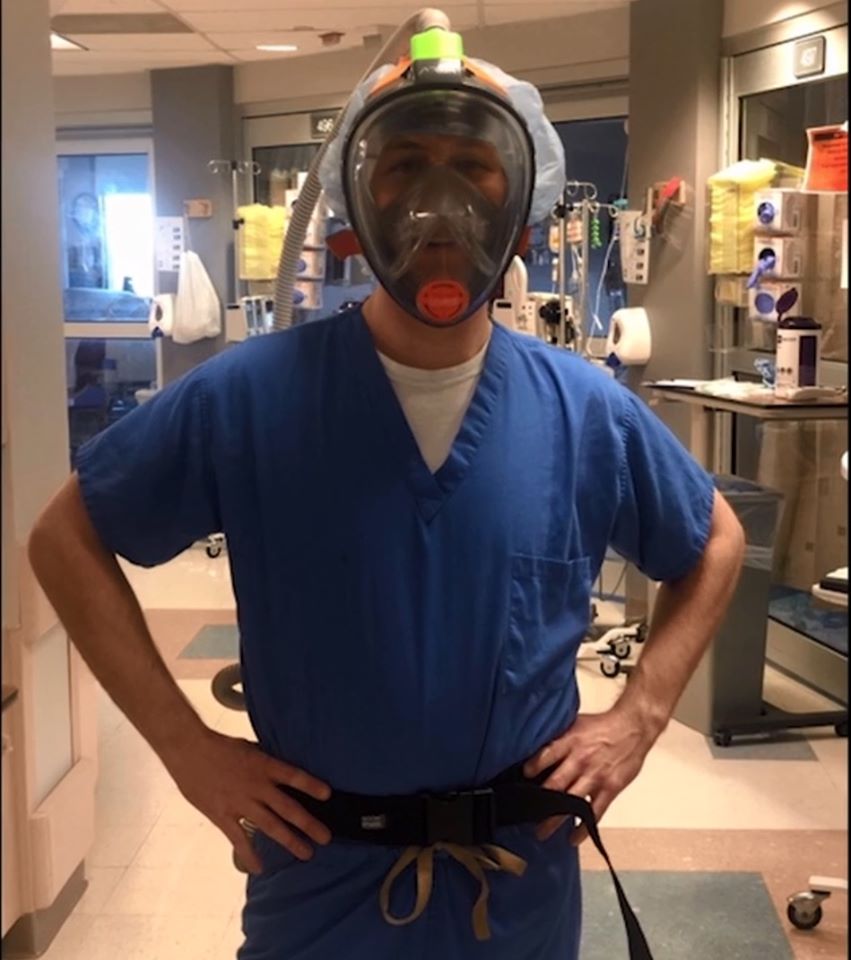

Please Help Hunter Engineering

posted by: Wildfire Internet on Tuesday April 7, 2020

Hunter Engineering has teamed up with Washington University, St. Louis, to design powered air purifying respirator (PAPR) devices for emergency medical professionals treating COVID-19 patients.

(Photo is of first device in use at Missouri Baptist Hospital.)

You may be able to HELP, with the one critical part that is in in short supply!

If you have a CPAP machine that you no longer need

Please Help Hunter Engineering

posted by: Wildfire Internet on Tuesday April 7, 2020

Hunter Engineering has teamed up with Washington University, St. Louis, to design powered air purifying respirator (PAPR) devices for emergency medical professionals treating COVID-19 patients.

(Photo is of first device in use at Missouri Baptist Hospital.)

You may be able to HELP, with the one critical part that is in in short supply!

If you have a CPAP machine that you no longer need

The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday April 3, 2020

Some Highlights:

The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday April 3, 2020

Some Highlights:

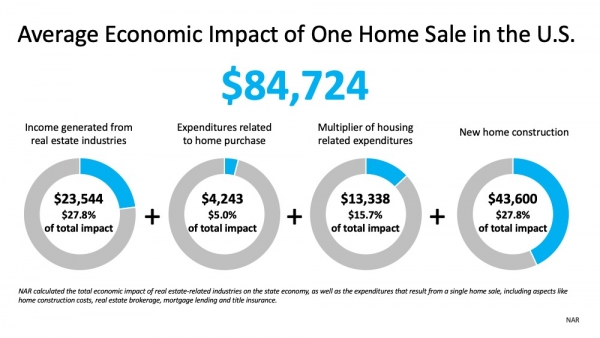

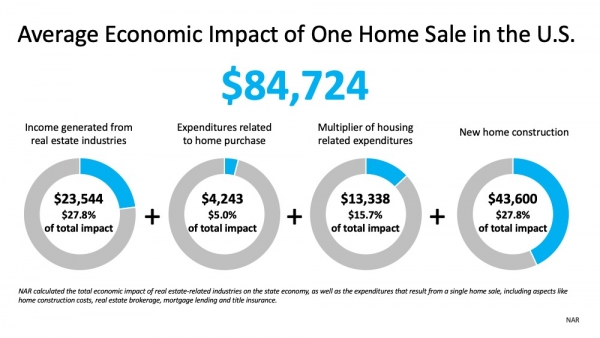

The Economic Impact of Buying a Home

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday March 31, 2020

We’re in a changing real estate market, and life, in general, is changing too – from how we grocery shop and meal prep to the ways we can interact with our friends and neighbors. Even practices for engaging with agents, lenders, and all of the players involved in a real estate transaction are changing to a virtual format. What isn’t changing, however, is one key thing that can drive the local economy: buying a home.

We’re all being impacted in different ways by the effects of the coronavirus. If you’re in a position to buy a home today, know that you’re a major economic force in your neighborhood. And while we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

Every year the National Association of Realtors (NAR) shares a report that notes the full economic impact of home sales. This report summarizes:

The Economic Impact of Buying a Home

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday March 31, 2020

We’re in a changing real estate market, and life, in general, is changing too – from how we grocery shop and meal prep to the ways we can interact with our friends and neighbors. Even practices for engaging with agents, lenders, and all of the players involved in a real estate transaction are changing to a virtual format. What isn’t changing, however, is one key thing that can drive the local economy: buying a home.

We’re all being impacted in different ways by the effects of the coronavirus. If you’re in a position to buy a home today, know that you’re a major economic force in your neighborhood. And while we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

Every year the National Association of Realtors (NAR) shares a report that notes the full economic impact of home sales. This report summarizes: